At his home office in Boca Raton, Florida, Marc Bell picks up a polished black box from his desk.

“This is why the world changed,” says the founder, president and CEO of investment firm Marc Bell Capital Partners, holding something a little bigger than a Rubik’s cube. “This is what made space travel affordable.”

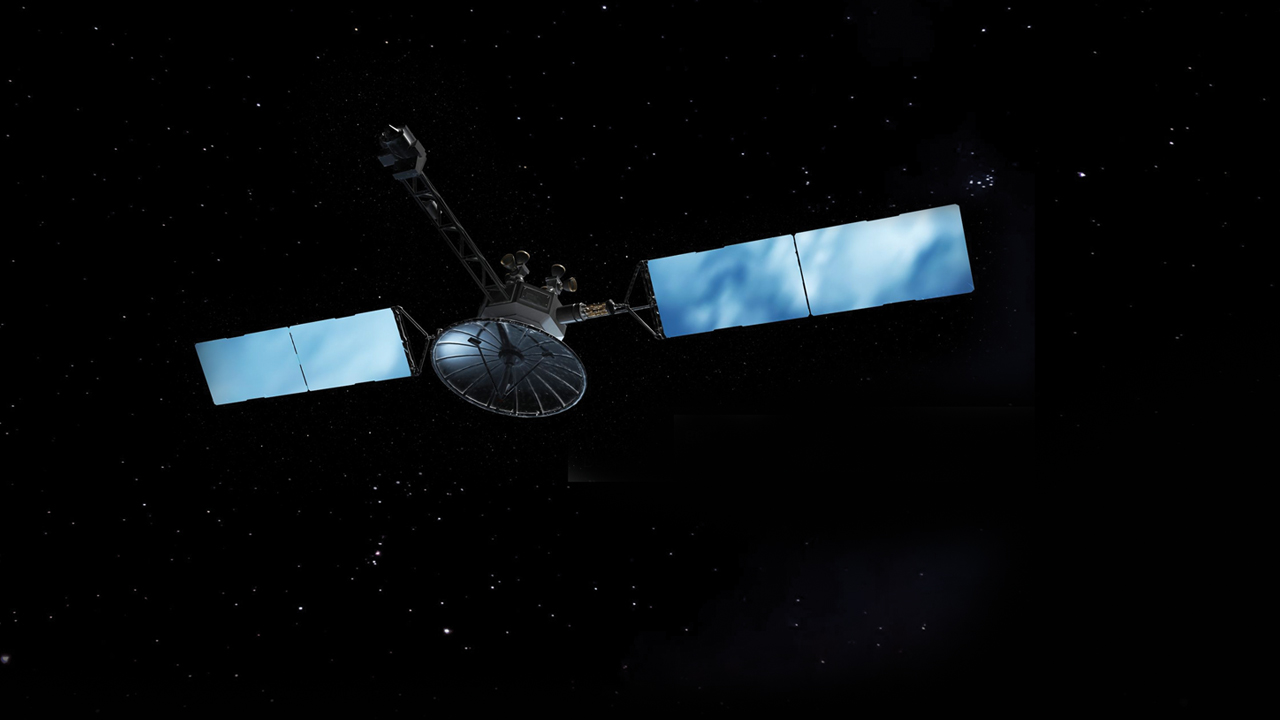

Weighing around six pounds, the pint-sized satellite in Bell’s hand was designed and built by Tyvak Nano-Satellite Systems, a subsidiary of Terran Orbital, of which Bell is co-founder and chairman. A version of the satellite platform, the Trestles 6U, launched into orbit in December 2019, and it’s one of the innovations leading more companies into space by drastically reducing the weight—and therefore cost—of getting into orbit.

Not long ago, space was the exclusive domain of publicly funded initiatives and a few large private players, but declining costs from breakthroughs like Tyvak’s miniature satellite, SpaceX’s partially reusable Falcon 9 rocket and the development of in-orbit manufacturing are opening up space to more private companies and drawing interest from investors.

A 2018 estimate from the Space Frontier Foundation, an advocacy group that supports the private space industry, valued the total annual revenue generated by companies that produce spacecraft or collect and analyze satellite data at around $350 billion. Reports from Goldman Sachs, Deloitte and Morgan Stanley project the space industry could reach $1 trillion to $2 trillion by the 2040s.

Investors have spotted the opportunity. In 2019, there were 159 disclosed deals in the space technology sector, a nearly 10% increase from the year before, according to data from PitchBook. One of the largest deals was the $110 million venture round for the Sierra Nevada Corporation, a designer and maker of hardware like space suits and spacecraft components.

Despite a downturn in M&A due to the pandemic, this year’s deals include the $1.64 billion acquisition of satellite imaging firm Dynetics by Leidos, an aerospace and defense company.

Filling the Middle Space

Like many cutting-edge industries, the space technology industry has a bookending problem. Peter Cannito, chairman and CEO of Redwire, a spacecraft component manufacturer, describes it as akin to a barbell: big companies on one end, early-stage ventures on the other, and not much in between.

“You either have large, legacy aerospace organizations that struggle to adapt rapidly enough to new innovation, or small companies that don’t have the scale to take on major programs or move disruptive technologies into production,” Cannito says.

The imbalance between startups and incumbents also poses a challenge for investors, he adds. “It means you have to invest in too many small transactions in order to move the needle, and there are no new entrants capable of producing above-average returns at scale.”

"middle" - Google News

November 19, 2020 at 09:08PM

https://ift.tt/3nCZS8S

The Middle Market's Next Frontier - Middle Market Growth

"middle" - Google News

https://ift.tt/2MY042F

Shoes Man Tutorial

Pos News Update

Meme Update

Korean Entertainment News

Japan News Update

No comments:

Post a Comment