Amazon registered nearly $89 billion in sales and $5 billion in profit over the last three months, setting company records on both figures and blowing away Wall Street expectations as Covid-19 pandemic shutdowns pushed more shoppers online and into Amazon’s arms.

CEO Jeff Bezos had said last quarter that the company planned to spend around $4 billion on pandemic-related health and safety efforts for its workers throughout April, May, and June, and that those expenses might wipe out all of the company’s profit over the quarter. Instead, Amazon customers surprised company executives by expanding their pandemic-driven purchases beyond low-profit goods like groceries — sales of which still tripled year over year in the quarter — into more profitable “hardline” categories like electronics and “softline” goods like clothing. That’s what helped the company set a record profit, eclipsing the previous record of $3.6 billion in profit in the first quarter of 2019.

“Prime members ... were shopping more often and with larger baskets,” Amazon Chief Financial Officer Brian Olsavsky told reporters on a media call Thursday afternoon. Recode previously reported that Prime membership sales have risen significantly since the crisis began.

For months, the pandemic has transformed Amazon from a popular convenience shopping destination into an essential service as stay-at-home orders pushed more shopping online and as non-grocery brick-and-mortar chains have suffered from temporary store closures. But it also posed challenges for the tech giant. The company suffered from long delivery times as it reworked its warehouse policies to keep up with demand; along the way, it hired 175,000 warehouse and delivery workers to help with the sales boom and to fill in for workers who got sick or chose to stay home.

But the company also faced a labor crisis as some workers said the company’s warehouse safety measures were not adequate or consistent enough, and decried the company’s move to end bonus hourly and overtime pay at the end of May. Amazon ended up announcing another one-time bonus in June, declining to label the bonus as hazard pay, describing it instead as an appreciation for workers dealing with increased demand during an unprecedented time. An Amazon spokesperson on Thursday refused to say whether the company might reinstate the extra hourly or bonus pay even though increased orders and sales show no signs of abating for the company and its workers.

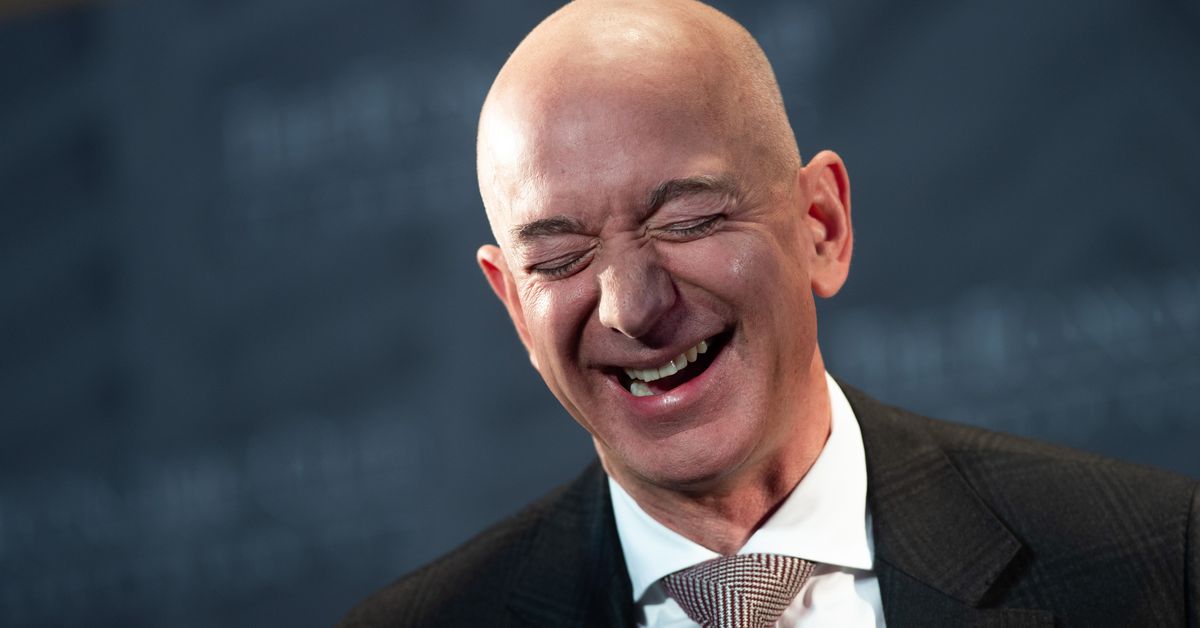

The record quarterly profit and sales figures, which eclipsed Wall Street analyst expectations by a staggering $8 billion, highlight Amazon’s growing power in the US economy. And it comes a day after a committee of US lawmakers grilled Bezos, the world’s richest man, on the business practices that Amazon has used to ascend to its increasingly dominant position.

Much of the lawmakers’ questioning on Wednesday focused on how the company treats and competes with the third-party sellers that account for more than half of the items Amazon sells in its online stores. Amazon revenue from these sellers grew 53 percent in the last quarter, up from growth of just 25 percent in the same quarter last year. Amazon CFO Olsavsky told Recode on the media call that growth in Amazon’s Fulfillment by Amazon (FBA) service — which lets sellers qualify their goods for Prime shipping by paying Amazon to handle warehousing and shipment of goods — was a main driver in seller fees.

Some critics have argued that Amazon coerces sellers into using FBA by giving better placement to goods that ship with Prime and by penalizing them for late deliveries if they ship on their own. One seller told federal regulators in a letter last year that the practice forces him to charge consumers higher prices than he otherwise would. Amazon, including Bezos in his congressional testimony, has defended FBA as a service that saves sellers considerable hassle.

While Amazon’s business continues to benefit from the pandemic, some other mass retailers are also seeing a boost. Both Walmart and Target have posted standout earnings reports in recent months, and their market share in US online commerce has increased, according to shopping data research firm Rakuten Intelligence, though Amazon’s share is still around seven times larger than Walmart’s.

Support Vox’s explanatory journalism

Every day at Vox, we aim to answer your most important questions and provide you, and our audience around the world, with information that has the power to save lives. Our mission has never been more vital than it is in this moment: to empower you through understanding. Vox’s work is reaching more people than ever, but our distinctive brand of explanatory journalism takes resources — particularly during a pandemic and an economic downturn. Your financial contribution will not constitute a donation, but it will enable our staff to continue to offer free articles, videos, and podcasts at the quality and volume that this moment requires. Please consider making a contribution to Vox today.

"middle" - Google News

July 31, 2020 at 06:06AM

https://ift.tt/3fdf4VB

Amazon posted record sales and profit in the middle of a pandemic - Vox.com

"middle" - Google News

https://ift.tt/2MY042F

Shoes Man Tutorial

Pos News Update

Meme Update

Korean Entertainment News

Japan News Update

No comments:

Post a Comment